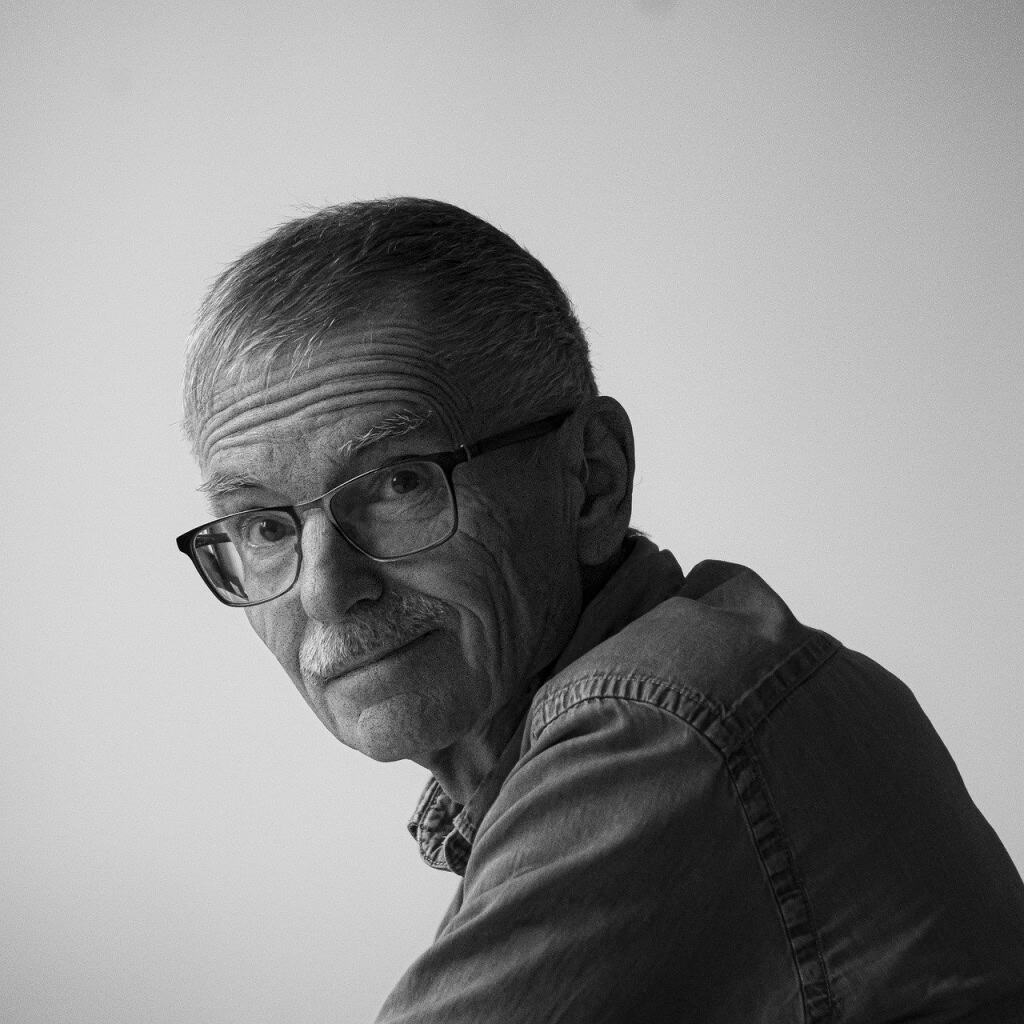

Estate Planning Tax Considerations with Mark Mastrarrigo, Attorney at Law

When it comes to estate planning, tax considerations play a crucial role in ensuring your assets are protected and passed on to your loved ones efficiently. In West Hollywood, Florida, Mark Mastrarrigo, Attorney at Law, offers comprehensive estate planning tax considerations services to help clients navigate the complex landscape of tax laws and regulations.

Services provided within estate planning Tax Considerations

Mark Mastrarrigo specializes in providing personalized estate planning services that take into account the unique financial situation of each client. Some of the key services offered within estate planning tax considerations include:

- Estate tax planning

- Gift tax planning

- Trust formation

- Asset protection strategies

- Charitable giving planning

- Business succession planning

These services are designed to help clients minimize tax liability, protect their assets, and ensure their wishes are carried out according to their estate plan.

What makes our estate planning Tax Considerations services the best

What sets Mark Mastrarrigo’s estate planning tax considerations services apart is his dedication to providing personalized and strategic solutions for each client. He takes the time to understand his clients’ goals, concerns, and financial situation to create a comprehensive estate plan that meets their needs.

Mark Mastrarrigo stays up to date on the latest tax laws and regulations to provide his clients with the most effective strategies for minimizing tax liability and maximizing wealth transfer. He works closely with financial advisors, accountants, and other professionals to ensure a comprehensive approach to estate planning that addresses all aspects of his clients’ financial well-being.

Additionally, Mark Mastrarrigo prioritizes ongoing communication and education, ensuring that his clients understand the implications of various tax considerations and are equipped to make informed decisions about their estate plan.

Mark Mastrarrigo’s commitment to excellence, attention to detail, and personalized approach make his estate planning tax considerations services the best choice for individuals and families in West Hollywood, Florida who are looking to protect their wealth and legacy.

Conclusion

When it comes to estate planning tax considerations, working with a knowledgeable and experienced attorney like Mark Mastrarrigo can make all the difference. With personalized strategies, a deep understanding of tax laws, and a commitment to client education, Mark Mastrarrigo’s services stand out as the best in West Hollywood, Florida. Whether you are looking to minimize tax liability, protect your assets, or ensure your wishes are carried out, Mark Mastrarrigo can help you create a comprehensive estate plan that meets your needs and goals. Contact Mark Mastrarrigo, Attorney at Law, today to learn more about how estate planning tax considerations can benefit you and your loved ones.

Contact Us Today

Don’t wait to protect your legacy. Contact our expert team of Florida estate planning attorneys today for a consultation. We are here to guide you through the estate planning process and provide you with the peace of mind that comes with knowing your assets and loved ones are secure. Call us at (954) 820-8535 or send Mark a direct email at Mark@markmlegal.com. We have convenient locations throughout Florida to serve you.